Hear from our Speakers:

Interview with Ethan Cohen-Cole, Co-Founder & CEO, Capture6

What are some of the key milestones you’ve hit in the last 12 months?

Ethan: Capture6 is scaling rapidly across three continents, with four water-positive carbon removal projects underway in the U.S., South Korea, New Zealand and Australia. In July, we announced our partnership with Isometric, the world’s leading carbon removal registry, to issue trusted, high-quality DAC credits from Project Wallaby, Capture6’s pilot DAC facility in Western Australia. This follows on from last year’s pre-purchase agreement for 1,000 tons of carbon removal from Project Wallaby by Frontier on behalf of Shopify and Stripe.

Where are you in your funding journey and what’s next?

Ethan: In March 2025, we completed a $27.5 million Series A and project funding round—a major catalyst for advancing our existing global pipeline. Over the next year, we are looking to deepen both project-level and company-level investment to mainstream decarbonization in heavy water infrastructure. Desalination is one of the fastest-growing water supply solutions worldwide, but it produces vast amounts of brine and CO₂ emissions. By embedding our technology directly into desalination facilities, we can simultaneously recover valuable freshwater, permanently remove atmospheric carbon, sell high-quality carbon credits and eliminate brine disposal costs for partners.

What are you seeing as the biggest current bottlenecks – technology, talent, financing, or policy?

Ethan: Right now, we aren’t facing the industry’s larger policy bottlenecks, and that’s by design. Instead of relying on uncertain voluntary or compliance markets, Capture6 is designing our operations to integrate directly into existing industrial ecosystems like desalination. By tapping into established infrastructure and market demand, we can scale faster and at lower cost, reducing our exposure to the financing and policy constraints that slow others down. In other words, our model is built to turn these external bottlenecks into strategic advantages.

What kind of connections or conversations are you hoping to have at TechInvest?

Ethan: I’m looking forward to connecting with investors who see the opportunity in infrastructure-scale climate solutions—assets that generate reliable returns while delivering measurable carbon removal and water recovery.

Climate Investor Market Sentiment Survey: 2025 - Exclusive Report by Sightline Climate

Sightline Climate are pleased to present the findings of their 2025 Investor Market Sentiment Survey

The report answers questions such as:

- What is your outlook on climate tech valuations for the remainder of 2025?

- What is your biggest concern for the climate tech ecosystem in 2025-2026?

- What climate tech sectors do you believe are most ripe for investment in 2025?

- At which development stages do you anticipate companies will face the greatest financing challenge in 2025-2026?

- Whatʼs one climate tech trend arenʼt getting enough attention but will be significant in the next 12 months?

Tech Disruptors Report

The report showcases 30+ hardware innovators driving real progress in industrial decarbonization, from clean hydrogen and carbon removal to low-carbon materials.

Featured companies, including Utility Global, Boston Metal, Sublime Systems, and more, are disrupting the sectors in which they operate to tackle the deeply entrenched challenges of decarbonizing process industries.

This report offers a snapshot of the founders and technologies shaping the sector. Whether you’re an investor, corporate, or policymaker, it’s a valuable guide to the tech and talent leading the charge in decarbonization breakthrough technology.

Industrial Competitiveness in an Era of Policy Flux - Exclusive Report by AJW, Inc.

Identifying Opportunities for Smart Industrial Investment U.S. industry faces a paradoxical landscape in its pursuit of modernization, efficiency, and increased competitiveness: immense opportunity muddled by conflicting policy signals. This fog of uncertainty hampers decision-making, and with it, the ability to make investments to replace outdated equipment or add new capacity, especially since success depends on recouping the investment over years, not months.

AJW, Inc. has created an exclusive report designed to decode U.S. regulatory uncertainty for industry with regard to decarbonization, addressing the complex challenge for entities striving to invest in modernizing existing operations or adding new capacity.

Podcast Episode: Turning Water into Climate Action via CDR – Garrett Boudinot on VyCarb's Novel CDR Tech

In this episode of the Decarb Connect Podcast, Alex Cameron is joined by Garrett Boudinot, climate scientist and CEO of VyCarb, a Brooklyn-based startup pioneering a novel approach to carbon dioxide removal (CDR).

VyCarb’s technology harnesses the natural carbon cycle of water to convert CO₂ into stable bicarbonate, offering a verifiable and permanent storage pathway that bypasses the geographic and infrastructure limitations of conventional geologic storage.

Garrett shares how his background in ocean carbon chemistry led to the development of a modular, sensor-integrated system that operates at low CO₂ concentrations and near industrial emitters. The conversation explores how VyCarb’s solution is being piloted with major industrial players like Rio Tinto and BlueScope Steel, and how the technology could support both voluntary carbon markets and direct decarbonization across sectors.

What You’ll Learn in This Episode:

- How VyCarb mimics ocean chemistry to convert CO₂ into stably stored bicarbonate

- Why low-purity CO₂ streams—common across industry—are a key focus for deployment

- The limitations of geologic CO₂ storage and how VyCarb overcomes them

- How integrated sensing enables real-time verification and control of the carbon conversion process

- Practical implications for cement, steel, aluminum, and oil & gas emitters

- How existing wastewater discharge permitting can support project rollout

- Insights into VyCarb’s current pilot in Brooklyn and its industrial integration roadmap

- What scale-up looks like and why the economics could reach below $100/ton

Life Cycle Diligence to Shore Up Mission Critical Supply Chains

A New Approach to an Increasingly Fickle Problem.

Although venture capital firms often hoover up headlines for making flashy cleantech bets, later stage financings are arguably more intriguing and more impactful. In 2023, as venture firms touted their $5.5b in North American cleantech investments, $135b were quietly deployed into the same sector by private equity in the form of debt and tax equity financing, meaning that for every dollar invested by venture capitalists, $25 were invested in clean energy projects. Cleantech manufacturing commands massive investment as well: globally, investors poured over $180b into PV and battery manufacturing in 2023, a 70% increase over 2022.

Because manufacturing and project investing require patient capital and are reliant on complex supply chains, they face significant supply chain risk which must be managed. While VC exit timelines are typically less than 7 years, infrastructure payback periods can take up to 10 years, while battery manufacturing plants may see payback periods of 8 to 13 years. Together, these asset classes are exposed to supply chain risk as a function of scarcity and geopolitical uncertainty.

The key challenge for project and manufacturing investors over the next decade will be derisking access to key materials. This means that cleantech investors need a reliable method for ensuring supply chains are sustainable and derisked from climate-related disruption. Life Cycle Diligence, which combines Life Cycle Assessment and Techno-Economic Analysis, is an effective way of doing this.

Beyond Series B: Scaling Hardware Tech to Tackle Industrial Emissions – What does it take to succeed?

This Digital Roundtable brought together capital providers from across the funding spectrum to explore what it really takes to scale hardware technologies for industrial decarbonisation. We’ll dissect what’s needed to build bankable business models, structure de-risked project portfolios, and secure the talent, capital, and partners to deliver sustainable, scalable impact.

- What investors across the capital stack prioritise today—across technologies, business models, and markets—and how evolving regulatory and geopolitical landscapes shape investment decisions

- Industrial perspective on what drives technology adoption—when they choose to co-develop, how they evaluate commercial viability, and what truly differentiates a scalable hardware solution.

- First-hand perspectives from Series B+ climate tech companies on the practical barriers to growth—from talent gaps to navigating customer demands, permitting, and building bankable infrastructure pipelines.

- Transitioning from startup KPIs to metrics that drive profitability, customer traction, and infrastructure-readiness—plus how leadership teams evolve to meet these demands.

- Practical take-aways for start-ups to consider and implement as they plan to scale from initial concept to bankable business.

Speakers include:

Jonathan Tudor, Investment Partner, Clean Growth Fund

Misa Andriamihaja, CEO, Green Ventures

Diane Frachon, Director New Energy UK & Corporate Ventures, SLB

Shanbor Gupta, Principal, Clean Energy Ventures

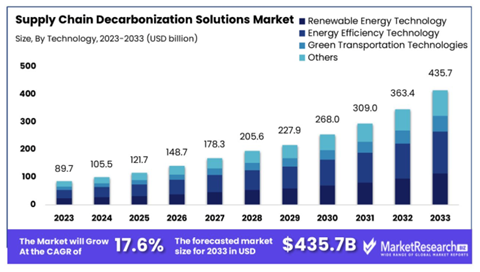

FREE WHITEPAPER: Mastering Scope 3 Emissions: Strategies for Supply Chain Decarbonization

Decarbonizing supply chains is no longer a nice-to-have—it’s a business imperative. With Scope 3 emissions often making up more than 80% of a company’s total carbon footprint, and mounting pressure from stakeholders and regulators, taking action today is essential to stay ahead.

That said, Scope 3 can be tricky. From inconsistent data and limited supplier engagement to logistics-related emissions, the challenges are real—but solvable.

This white paper explores how STRIVE by STX helps companies navigate those challenges with practical tools and strategies that turn climate ambition into measurable impact.

Inside, we cover:

- Laying the foundation: How to collect better data, calculate footprints and set science-based targets that reflect real supplier activity

- Building a clear plan: Creating a Scope 3 strategy aligned with global regulations like CSRD, CBAM and CSDDD

- Unlocking supplier action: Combining engagement programs with tailored support to help suppliers set targets, measure emissions and access renewable energy, low-carbon fuels and efficiency solutions

- Reducing transport-related emissions: Supporting decarbonization in freight and travel through approaches like SAF and insetting

Download the full white paper to explore practical solutions and take your next step toward a low-carbon value chain.

Podcast Episode: FOAK 2.0 - What I learned in the last year since FOAK emerged as a concept

First-of-a-Kind (FOAK) projects are critical to scaling breakthrough decarbonization technologies, yet they don’t fit neatly into traditional funding models. Investors, developers, and strategic partners need to navigate a complex ecosystem to make these projects bankable and viable.

In this episode, Alex Cameron, CEO of Decarb Connect sits down with David Yeh, a veteran climate tech investor and one of the key voices from our Decarb TechInvest event last autumn. He’s been at the forefront of FOAK investing and is here to share what he’s learned over the past year about getting these projects off the ground.

Laying the Foundation of a Clean Future

We owe a lot to cement. Buildings, bridges, a dangerously warming planet.

No building material on Earth emits more CO2 than cement. And no building material is more ubiquitous. See where I’m going with this? For those keeping score at home, cement production makes up a full 8% of all global CO2 emissions.

In no universe is traditional cement compatible with a clean, decarbonized economy. But how do you convince builders to give up something they love for its strength, versatility, and availability? You replace it with something just as strong, versatile, and available. But without the carbon. A.K.A. the Sublime game plan.

Ones to Watch: Climate Tech Start ups and Scale ups 2025

It’s not news that for industrials and regions to hit net zero targets there’s a need for innovation, there’s a need for climate tech. It’s estimated that 40% of cumulative emission reductions rely on new climate technologies and so far, we’ve met some amazing startups and scaleups disrupting the space across: CCUS, alternative fuels, industrial heat and electrification.

To support investors and financiers in identifying these innovative tech disruptors, we’ve compiled all of the applications we’ve received across the Decarb Connect North America and Decarb Connect Europe 2025 Next Gen Awards. Bringing to you a Startups and Scaleups 2025 Report.

We’ve provided a brief introduction to the company (as they explain who they are) and where available we’ve included their tech readiness level (TRL), website link and key contact information.

The Next Gen Awards are a crucial aspect of Decarb Connect North America and Decarb Connect Europe flagship events. They recognise and celebrate innovation towards industrial decarbonisation. These companies are only a snapshot of the many amazing climate tech companies out there.

Whether you’re a startup, scaleup, industrial, or investor, this report will provide you with some insight into new technologies driving down emissions and changing our future.

Dirt Cheap Mining. Literally.

Crazy is just another word for massive untapped potential.

Most ideas that change the world sound pretty bonkers at first. Phytomining, for example — using plants to “farm” metals — was once a pipe dream. Certain scientists have pursued it for decades, but it was mostly written off as too inefficient and expensive to be practical. Then along came Genomines. What was once a niche academic specialty is now outpacing traditional nickel mining in profitability, speed, and scale, all while healing the land. “Can’t work” is rapidly becoming “can’t miss” — and changing how we think about mining.

Is zero the new minimum for CO2 capture?

Historically carbon capture has been characterized by high energy consumption, leading to undue costs and barriers to adoption. Mantel’s molten borate carbon capture technology can virtually eliminate the energy penalty associated with carbon capture, enabling heavy industry to reduce CO2 emissions at exceedingly low costs. At first glance an energy penalty approaching zero appears unattainable. This article outlines how Mantel is able to recover energy from the CO2 capture step in a manner that offsets the energy requirements of the CO2 regeneration step. A number of different perspectives are taken to explain this concept for different readers.